Cryptocurrencies come in a variety of shapes and sizes. The most common types will be discussed in this article. Each type has its own set of characteristics and advantages. What criteria do you use to determine which type is best for you? This guide will teach you how to choose the right type of cryptocurrency and how to accept it as payment.

What Are the Different Types of Cryptocurrencies?

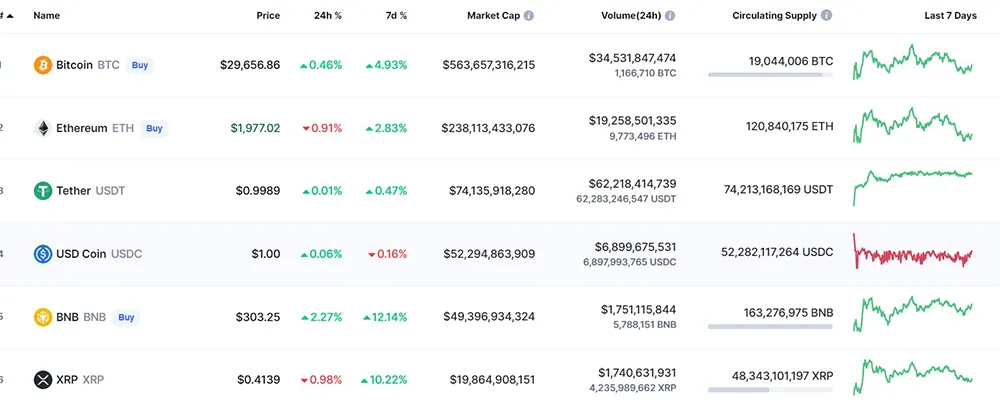

Individual cryptocurrencies come in a variety of shapes and sizes, and their prices fluctuate. According to coinmarketcap.com, a price-tracking website for crypto assets, there were 1,583 different individual types in 2018.

While you may have heard and seen the most about Dogecoin thanks to gregarious Tesla CEO Elon Musk, Bitcoin and Ethereum are the most popular forms of this digital currency. In terms of market capitalization, you’ll usually find these two types of digital money at the top of the cryptocurrency market list.

How to Choose the Right Cryptocurrency and Digital Assets

Investing in digital assets and cryptocurrency is one of the most crucial decisions you will ever make. With so many different types of digital currencies to choose from, it can be difficult to know which one is right for you. Furthermore, there are numerous factors to consider when selecting the appropriate type of cryptocurrency.

Do your homework first and foremost. This is, without a doubt, the most crucial piece of advice. When it comes to assets and cryptocurrencies, don’t take anyone’s word for it. There are many frauds and scams out there, so do your homework before making any decisions.

Here are a few more things to think about when selecting the right type of cryptocurrency for your needs:

- Understand the currency’s purpose: Not all crypto is created equal. Some people are safer than others. Some transactions are completed faster than others. Some people are more reserved than others. Before you choose crypto assets, think about what you need.

- Stick with higher-priced currencies: It’s best to stick with higher-priced currencies in general. They’re more likely to last a long time and are less vulnerable to being hacked or otherwise compromised.

- To understand how it compares and converts, consider the following: Consider how the price and market capitalization of crypto assets compare to those of other assets. How easy is it to exchange the currency for other assets such as cash or gold?

- Volatility: Be prepared for market volatility, particularly when it comes to cryptocurrency. Also, keep in mind that crypto assets have lower liquidity than traditional financial assets. As a result, it’s important to understand your risk tolerance.

- Consider the market capitalization: The total value of all the coins in circulation is the market capitalization, or market cap, of a cryptocurrency. It’s a good indication of a project’s success.

Cryptocurrencies Come in a Variety of Forms

The four main types on this list are not to be confused with individual cryptocurrencies, of which you saw there are SO many earlier. These four have their own set of advantages, risks, and goals. We’ll go over the various types so you can make an educated investment decision.

1. Workproofing

The first type of cryptocurrency, which began with Bitcoin, is at the top of this list. It conducts transactions using the blockchain, which employs the proof of work (or PoW) method.

When a transaction is completed, it is broadcast to the network, where miners compete to validate it by solving difficult mathematical problems. The first miner to solve the problem is rewarded with a small amount of cryptocurrency and gets to add the transaction to the blockchain.

The main advantage of PoW is that it is extremely secure, as attacking or manipulating the network is extremely difficult. However, because miners must solve complex mathematical problems in order to validate transactions, PoW can be quite energy-intensive.

2. Stakeholder Proof

Proof of stake (PoS) is the second most common type of cryptocurrency, and it was created to address the issue of PoW’s high energy consumption. Instead of miners competing to validate transactions, in PoS, the person with the most cryptocurrency in their wallet (i.e. the largest stake) is chosen to do so.

The main advantage of PoS is that it uses far less energy than POW because no complex mathematical problems must be solved.

Some argue that PoS is less secure than POW because the person who validates transactions can be manipulated or attacked more easily. Furthermore, because the person who validates transactions is often the one with the largest stake, PoS can be quite centralized. Dash and Tron are two well-known cryptocurrencies that use PoS blockchains.

3. Stablecoins

Stablecoins are the third major type of cryptocurrency, and they were created to address the issue of cryptocurrency market volatility. Stablecoins are cryptocurrencies that are linked to a stable asset, such as gold or the US dollar, and their value is less volatile than other cryptocurrencies.

Stablecoins have the advantage of being less volatile than other cryptocurrencies, making them a more stable investment. However, some argue that because stablecoins are pegged to a centralized asset, they are not truly decentralized.

4. Tokens of Utility

A utility token is a type of cryptocurrency that can be used to buy goods or services on a specific platform. They’re also known as “app coins” and “protocol tokens.”

Tokens have the advantage of having a use case, which gives them potential value. The main risk with tokens, however, is that their value is often highly speculative, as it is based on the platform’s future success.

Other Cryptocurrency Types

There are other digital currencies, in addition to the ones listed above, such as:

- Mining Rewards: Miners are rewarded with a small amount of cryptocurrency for their efforts in validating transactions with this type of cryptocurrency.

- Transaction Fees: Users are charged a small fee for each transaction they make with this type of cryptocurrency.

- Initial Coin Offerings (ICOs): Companies use this type of cryptocurrency to raise funds for their projects by issuing new crypto coins or tokens.

Which cryptocurrencies make use of blockchain technology?

Bitcoin was the first cryptocurrency to record transactions using blockchain technology. Meanwhile, it is used by the vast majority of cryptocurrencies. The bitcoin and Ethereum networks, for example, are built on blockchain technology.

Blockchain networks are frequently used to build smart contracts. The ERC-20 token standard, for example, is based on Ethereum’s blockchain. In short, ERC-20 tokens are used by a lot of popular altcoins and stablecoins.

What are the chances that society will adopt a blockchain-based economy?

A blockchain economy is one in which digital assets and cryptocurrencies are widely used and accepted, eventually displacing traditional monetary systems and financial institutions. The chances of the system being adopted globally appear to be favorable. By 2024, Gartner predicts that 20% of large companies will be using blockchain.

That said, blockchain technology is still in its early stages, and it’s too early to say whether society will fully embrace it anytime soon. It does, however, have the potential to forever alter how we interact with the digital world. However, some experts predict that blockchain will radically transform the global economy in the future, so it’s worth keeping an eye on.

What is the most affordable digital currency?

The most affordable cryptocurrency is usually the one with the smallest market capitalization, and it fluctuates. Of course, the term “cheap” is subjective. Almost every other cryptocurrency is relatively inexpensive when compared to Bitcoin. Bitcoin, for example, is currently trading at around $30,371.87, while Dogecoin is trading at around $0.087. (USD coin).

If you’re a small business owner reading this, you’re probably wondering how to accept cryptocurrency payments. While accepting Bitcoin cash is not as straightforward as accepting credit card payments, there are a few options.

Use a cryptocurrency payment processor like BitPay or CoinGate as the first option. These businesses will handle the complexities of crypto payment processing for you.

Another option is to use a cryptocurrency wallet that allows you to convert your cryptocurrency into fiat currency. The Edge wallet, for example, allows you to convert between Bitcoin and US dollars with ease.

Finally, you could create your own system to accept more cryptocurrency payments. Because it can be quite complex and time-consuming, this option is only recommended for businesses with the resources to do so. If you’re serious about the idea, however, it can really help with payments.

Learn more from Crypto and read What Cryptocurrencies Should I Buy in 2022?

One Comment