The rapid growth of cryptocurrencies has created new opportunities for investors, traders, and businesses. However, one of the biggest challenges the crypto industry faces is liquidity—the ease with which an asset can be bought or sold without causing major price fluctuations. This is where crypto market making plays a critical role.

Market makers bridge the gap between buyers and sellers, ensuring that digital assets remain tradeable, liquid, and efficient across different exchanges. For projects, exchanges, and institutional investors, understanding how market making works is crucial for navigating today’s fast-paced crypto economy.

What Is Crypto Market Making?

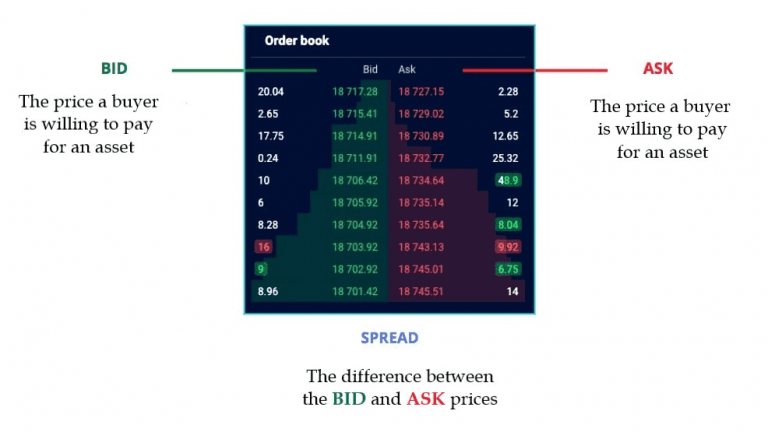

In traditional finance, market makers are entities that continuously quote buy (bid) and sell (ask) prices, profiting from the difference, known as the spread. They provide liquidity so that markets operate smoothly. The same concept applies in the digital asset space.

Crypto market makers:

- Provide continuous two-sided quotes (buy and sell orders).

- Reduce slippage for traders executing large orders.

- Help stabilize token prices and reduce volatility.

- Support exchanges in achieving deeper order books and higher trading volumes.

Without market makers, cryptocurrency markets would often be thin, inefficient, and prone to manipulation.

Why Liquidity Matters in Crypto

Liquidity is the lifeblood of any financial market. In crypto, it becomes even more critical due to high volatility and global participation.

Some of the main benefits of liquidity include:

| Benefit | Description |

|---|---|

| Price Stability | High liquidity prevents sudden swings when large trades occur. |

| Faster Execution | Traders can buy and sell without long waiting times. |

| Lower Costs | Tight spreads reduce transaction costs. |

| Market Confidence | Liquidity attracts more participants, reinforcing trust. |

For projects launching new tokens, working with professional market makers ensures that their token is accessible, competitive, and attractive to both retail and institutional investors. What if your crypto goes negative?

How Crypto Market Makers Operate

Modern market makers in crypto leverage both traditional trading expertise and cutting-edge technology. Their strategies often include:

- Algorithmic Trading – Automated bots adjust buy/sell quotes in real time.

- Cross-Exchange Arbitrage – Ensuring prices remain consistent across multiple trading venues.

- Inventory Management – Balancing token holdings to minimize risks.

- Risk Hedging – Using derivatives to reduce exposure to volatility.

By doing so, market makers not only profit from spreads but also create value for projects, exchanges, and traders.

Benefits for Token Projects

For blockchain startups or established projects launching tokens, partnering with market makers can deliver multiple advantages:

- Better Exchange Listings – Exchanges prefer tokens backed by reliable liquidity.

- Higher Trading Volumes – More activity makes the token attractive to investors.

- Price Efficiency – Helps prevent pump-and-dump schemes and manipulation.

- Investor Confidence – Liquidity reassures both institutional and retail investors.

In short, market making is not just about trading—it’s about building trust and long-term sustainability for digital assets.

Challenges and Risks

While crypto market making provides significant benefits, it also comes with challenges:

- Regulatory Scrutiny – Different regions may have varying laws on liquidity provision.

- Market Volatility – Sudden shifts can expose market makers to risk.

- Technology Dependence – Reliance on trading bots requires a strong infrastructure.

- Capital Requirements – Effective liquidity provision demands deep reserves.

Addressing these challenges requires expertise, advanced risk management, and a global approach.

The Future of Market Making in Crypto

As digital assets move toward mainstream adoption, the role of market makers will only grow. Decentralized finance (DeFi) protocols are already experimenting with automated market makers (AMMs), which use liquidity pools rather than centralized entities.

However, traditional and hybrid market making models remain essential for:

- Large institutional trading desks.

- Centralized exchanges are seeking deeper liquidity.

- Token projects aiming for stable long-term growth.

Firms like CLS Global are leading this evolution, combining advanced trading infrastructure with global liquidity networks to ensure crypto markets operate efficiently.

Conclusion

Crypto market making is the foundation of liquid, efficient, and stable trading environments. It reduces costs for traders, builds confidence for investors, and ensures that projects can successfully launch and grow in highly competitive markets.

For token projects and exchanges looking to thrive, professional crypto market-making services are no longer optional—they are a necessity.

By ensuring liquidity, reducing volatility, and supporting sustainable trading ecosystems, market makers play a vital role in shaping the future of digital assets.